Protecting an Equity Loan: Actions and Needs Explained

The Top Factors Why Home Owners Pick to Protect an Equity Funding

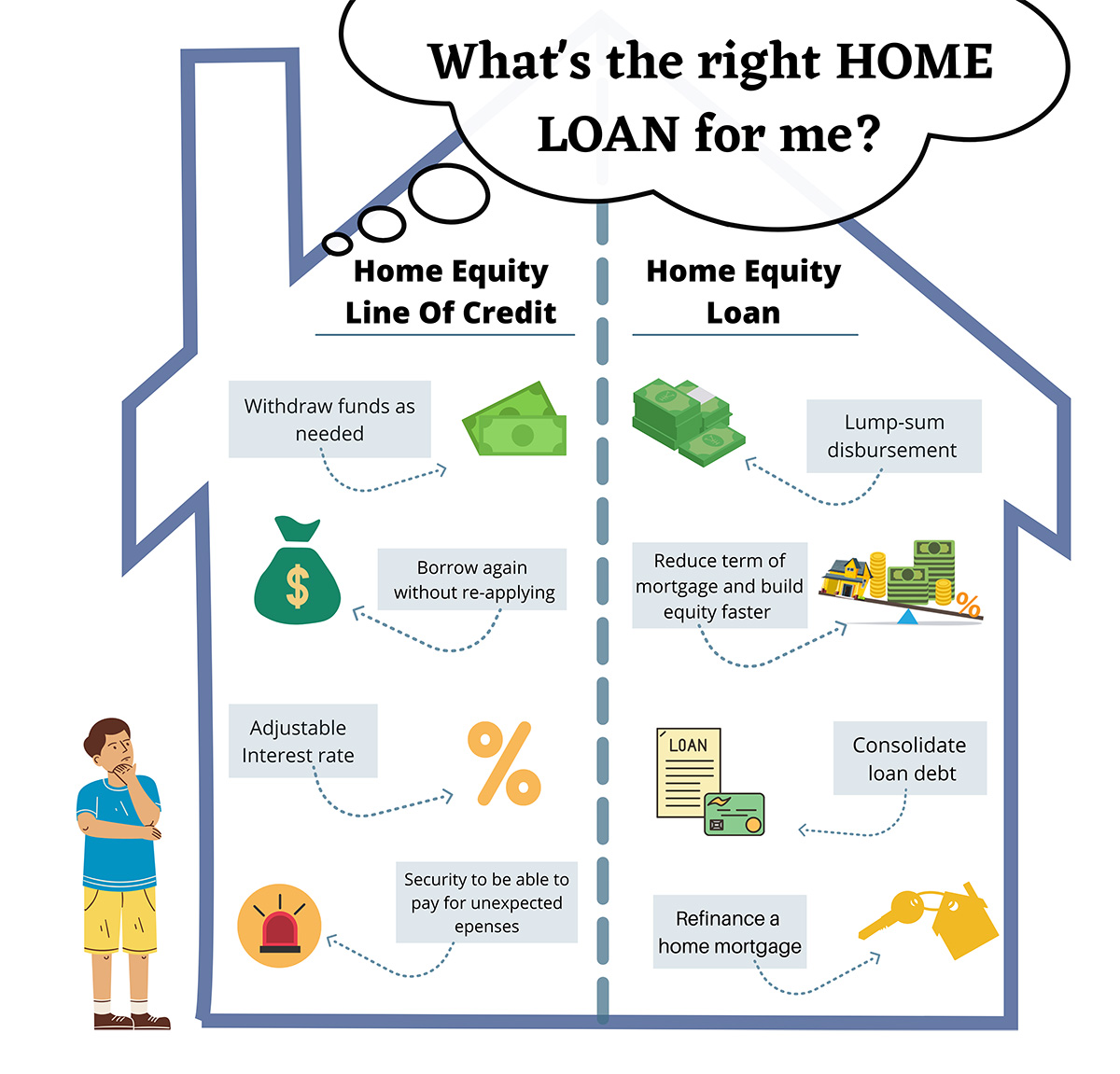

For several house owners, choosing to safeguard an equity car loan is a critical economic choice that can use different benefits. From consolidating debt to undertaking major home improvements, the factors driving people to opt for an equity financing are impactful and varied (Equity Loans).

Financial Debt Combination

Home owners usually choose protecting an equity financing as a strategic financial step for financial debt combination. By leveraging the equity in their homes, individuals can access a swelling sum of money at a reduced passion rate compared to other forms of loaning. This resources can then be made use of to repay high-interest debts, such as charge card equilibriums or personal fundings, permitting home owners to improve their financial responsibilities into a solitary, more convenient monthly settlement.

Financial obligation debt consolidation via an equity loan can offer a number of advantages to homeowners. First of all, it simplifies the payment procedure by incorporating numerous financial debts into one, lowering the risk of missed out on payments and prospective fines. The lower rate of interest price connected with equity car loans can result in considerable expense financial savings over time. In addition, consolidating financial obligation in this manner can boost a person's credit rating by minimizing their total debt-to-income ratio.

Home Improvement Projects

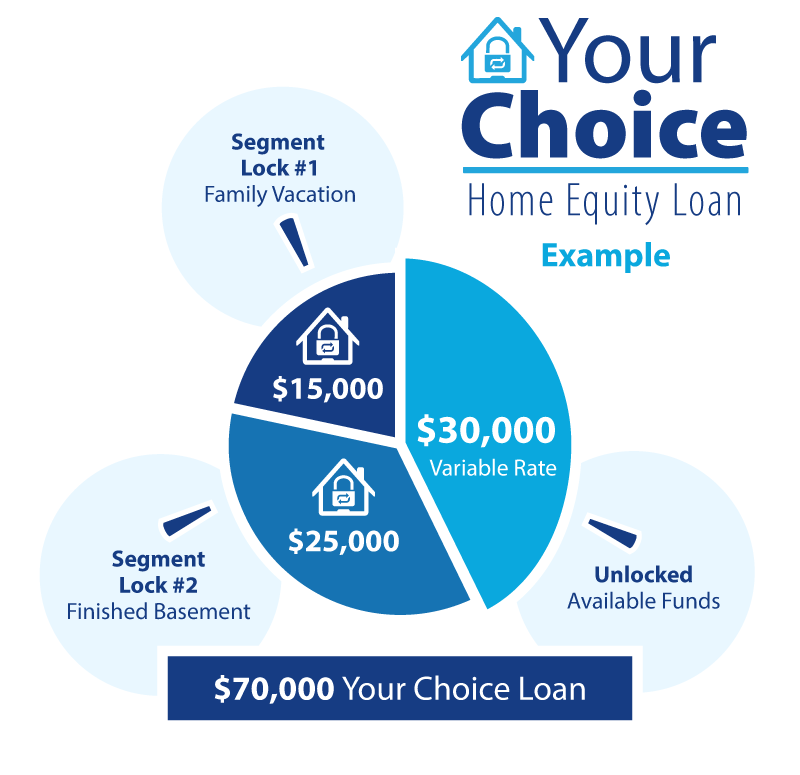

Considering the enhanced worth and functionality that can be attained via leveraging equity, several people opt to designate funds towards various home enhancement projects - Alpine Credits Equity Loans. Home owners usually select to protect an equity financing specifically for renovating their homes due to the substantial rois that such jobs can bring. Whether it's updating outdated functions, expanding space, or boosting energy performance, home renovations can not only make living rooms a lot more comfortable yet likewise increase the overall worth of the building

Typical home improvement tasks funded through equity car loans include kitchen remodels, washroom renovations, cellar finishing, and landscape design upgrades. These tasks not only boost the lifestyle for homeowners but additionally add to improving the aesthetic charm and resale worth of the building. Additionally, purchasing top notch products and modern layout elements can even more elevate the visual allure and functionality of the home. By leveraging equity for home renovation projects, property owners can develop areas that better suit their requirements and choices while also making a sound economic investment in their property.

Emergency Situation Expenditures

In unanticipated circumstances where immediate economic assistance is required, securing an equity car loan can supply home owners with a viable solution for covering emergency expenses. When unforeseen events such as clinical emergency situations, urgent home repairs, or sudden job loss emerge, having access to funds with an equity funding can supply a safeguard for house owners. Unlike other types of loaning, equity fundings normally have reduced rates of interest and longer settlement terms, making them an economical alternative for dealing with instant financial requirements.

Among the key advantages of making use of an equity finance for emergency situation expenditures is the rate at which funds can be accessed - Alpine Credits Canada. House owners can rapidly take advantage of the equity developed in their property, permitting them to address pressing financial issues immediately. In addition, the versatility of equity car loans enables property owners to obtain only what they require, preventing the burden of tackling excessive financial debt

Education And Learning Funding

Amid the quest of higher education, protecting an equity finance can work as a critical economic source for home owners. Education and learning financing is a substantial worry for lots of family members, and leveraging the equity in their homes can supply a method to accessibility necessary funds. Equity loans commonly offer lower interest prices contrasted to various other types of financing, making them an eye-catching alternative for funding education expenses.

By tapping into the equity accumulated in their homes, house owners can access considerable amounts of money to cover tuition fees, publications, holiday accommodation, and other associated costs. Equity Loan. This can be especially valuable for moms and dads aiming to sustain their kids with college or individuals looking for to advance their very own education. Additionally, the rate of interest paid on equity finances might be tax-deductible, supplying prospective financial benefits for consumers

Inevitably, using an equity financing for education and learning financing can help people buy their future earning capacity and profession advancement while properly handling their financial obligations.

Financial Investment Opportunities

Conclusion

To conclude, home owners pick to safeguard an equity finance for different reasons such as debt consolidation, home renovation tasks, emergency situation costs, education financing, and financial investment chances. These car loans provide a way for home owners to gain access to funds for essential financial demands and goals. By leveraging the equity in their homes, property owners can make the most of reduced rates of interest and adaptable payment terms to attain their economic goals.